With the help of the acceleration in the digitalization efforts, accounting software has become a must-have solution for businesses, particularly for small businesses. But shortlisting the solutions might be overwhelming. Here is a comparison of the best ones: FreshBooks and QuickBooks

Managing a small business’s accounting systems might be tough in terms of invoices, expense tracking, and cash flows. In fact, integration of the accounting software for your small business is even tougher.

When you start a new business or integrate your current business with well-established accounting services, your first must-have SaaS solution would be accounting software.

Many businesses are now looking for new accounting solutions to ease invoice processing, expense management, and payroll issues in order to be in line with the current systems. According to Gartner’s research, IT spending will grow by 4% in 2021, which will lead to the usage of accounting software will also increase in the next few years.

Accounting Software for Small Businesses

While working from home is spreading worldwide, accounting software usage is also increasing in the same way. The accounting systems are not anymore seen as office jobs as well as could be coordinated remotely.

Though small business owners are struggling to maintain their business in these unprecedented times, however, they complied with the new digital ecosystem quickly. Also, small businesses should follow several tips in order to keep moving in this post-pandemic era.

But still, they have a doubt about investing in new tools for their business due to limited budgets.

While investing in the accounting tool can be a burden for the budget in the short-term, they will benefit from the time-saving advantage of the accounting software, take control of the accounting process and record the financial data in the long-term.

If you are running a small agency, there will be other side benefits to using accounting software, like how much time you spent on your client, and efficiently process invoices in its time.

In this stage, the crucial question is how can you successfully run a compatible accounting business.

The first thing you could do is to find the best cloud-based services for your small business. Plenty of solutions can help you organize expenses, send invoices to the clients, and track your bottom line.

We’ve analyzed the FreshBooks vs. QuickBooks with the criteria below for better choices for your business:

- Core Features

- Pricing

- Integrations

FreshBooks vs. QuickBooks: Core Features

While both accounting software is a great choice for small businesses, however, they can work in different usage and types of businesses. Besides, if you are running a small business and have a plan to scale your business, it would be more suitable to use Quickbooks that is for mid-sized or fast-growing businesses.

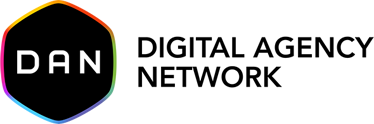

In terms of user-friendliness, FreshBooks offers remarkable user-friendly features for invoicing, expenses, time tracking, projects, and more. It has plenty of positive comments on the easy setup process.

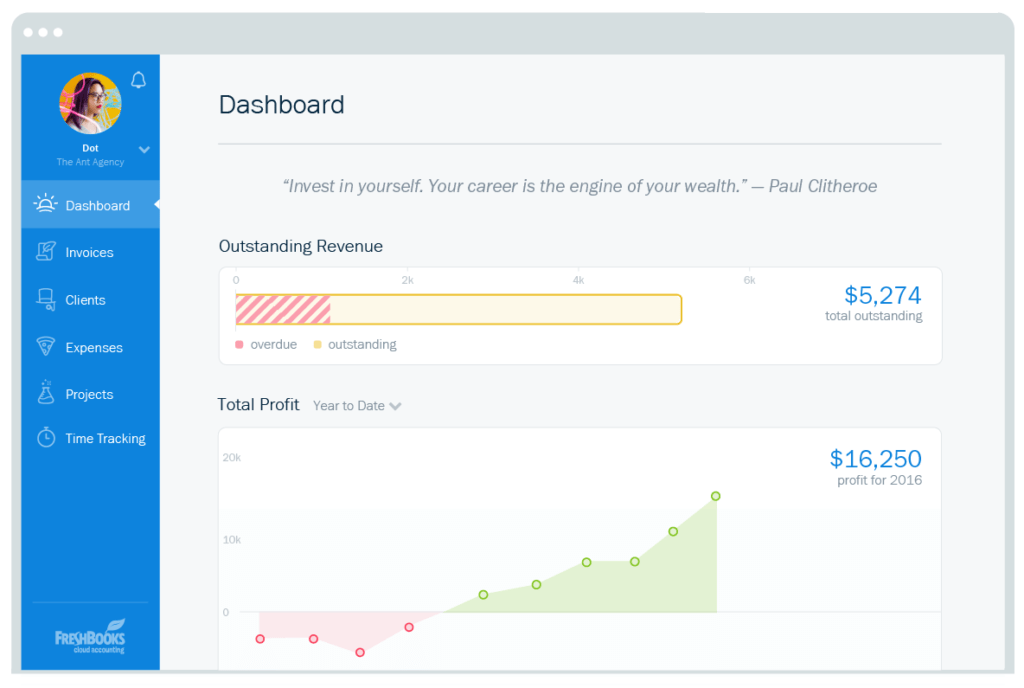

Also, Quickbooks has a great solution for accounting and creating invoices easily and it has an intuitive user interface.

Both accounting tools have a feature to look at the balance sheet as a whole in order to track your accounting history smoothly.

One of the crucial features that differentiate software we need an emphasis on is that you should use Quickbooks if you’re selling products or retail goods. On the other hand, Freshbooks is the tool for whom you are billing as a freelancer or managing clients as a small business.

Additionally, Freshbooks offers live customer support which is super beneficial for the accountants while Quickbooks give support via in-product help, phone support and product training.

With the feature of bank reconciliation, you can easily connect your bank institution with both platforms and track your bank transactions in real time. Also, both allow you to send a reminder to the client regarding overdue payments with the time tracking features.

The eCommerce feature of Quickbooks online allows you to use inventory management, and you can easily track your product availability. It also has a mobile app that allows you to analyze your financial transactions via your smartphone.

The difference between Freshbooks and Quickbooks is the capability to create advanced financial reports. While you can prepare excellent reports with Quickbooks, Freshbooks has limited reporting customization.

FreshBooks vs. QuickBooks: Pricing

For accounting services, pricing plans are one of the most important criteria when you are selecting the best one. The accounting software pricing changes according to how many invoices you want to send, how many clients you would like to add, payroll services, and advanced financial reports.

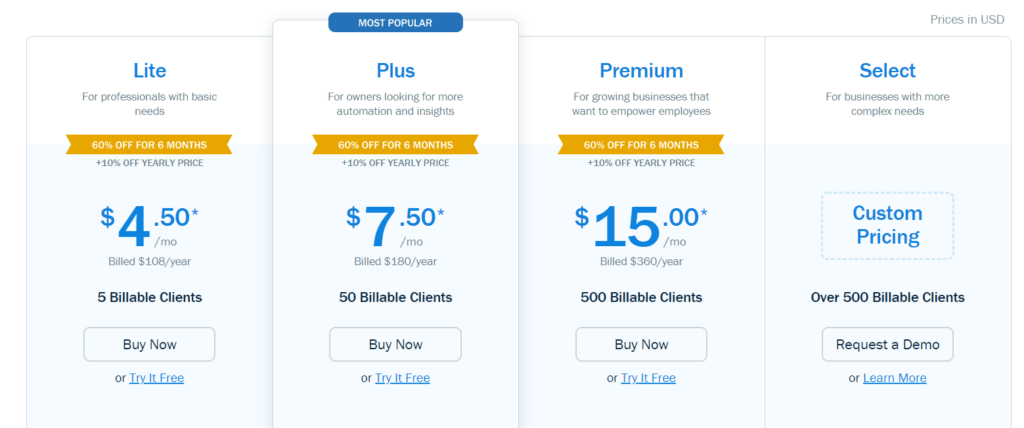

Freshbooks has a 30-day trial option and offers client-based plans. You may find the pricing for annually paid options below:

- Lite – $4.50 / 5 Billable Clients

- Plus – $7.50 / 50 Billable Clients

- Premium – $15.00 / 500 Billable Clients

- Select – Custom Pricing / over 500 Billable Clients

Quickbooks also offers a free 30-day trial for small businesses. They have 4 pricing plans, ranging from $15-$150 / month plan as follows:

- Freelancer – $15

- Simple start – $25

- Essentials – $70

- Plus – $150

Pricing ranges are pretty similar for both software, however, Quickbooks charge for a number of system users while Freshbooks calculate for billable clients.

When it comes to comparing this software for pricing, Quickbooks is much more expensive after the 3 months period, whereas Freshbooks pricing remains the same as the starting price.

FreshBooks vs. QuickBooks: Integrations

Current trends in the accounting business present various functionality on software with integrations of different related apps. Your small business might be more functional and automated with the integration of online payment services, like Stripe, PayPal and so on.

QuickBooks provides over 650+ integrations with popular business apps, whereas FreshBooks has 70+ integrations. However, you can connect the accounting software with Zapier over 1,500+ other software quickly and easily.

The volume of the integration reflects that Quickbooks is much more flexible than Freshbooks’ integrations.

What is the best alternative Accounting Software?

Xero

Search for alternative accounting software must be done by small businesses for sure. Doing this will help businesses avoid mistakes regarding selecting accounting software.

Xero would be the best alternative accounting software according to our research. Xero is also user-friendly, simple and strong alternative to Freshbooks and Quickbooks, and is designed to help their customers for creating invoices, managing expenses.

Like Quickbooks, Xero offers the ultimate solution for mid-sized companies to enterprises and also for small businesses. On the other hand, Xero has three pricing plans, ranging from $5.50 per month to $31 per month. It has much more reasonable pricing plans compared to Quickbooks. However, there is one thing that tool buyers should consider is that Freshbooks is more affordable than Xero

To sum up, if you are a growing startup, and do not want to have advanced reporting capabilities, Xero is the best alternative accounting software for your business.

Certainly, there is no clear winner in this comparison. But if you are just looking for invoicing, Freshbooks is best for your small business. If you want to start with more comprehensive accounting software and scale up your business, you need to focus on Quickbooks. In terms of financial reporting, Quickbooks also offers web-based advanced reporting solutions with much better customization options available.

For doing further research, you may want to see other accounting software, be sure that there is various other accounting software for your small business.

So obvious that starting to integrate accounting software is not an easy job. Once you decide on the best one for your small business and it did not work as you assumed, there will be no opportunity to switch the software you are using easily. For this reason, we advise you to be more decisive and deep-dive searching into the selecting accounting software.